Managing Taxes and Fees

Hi.Events provides flexible options for handling taxes and fees associated with your events. You can create custom tax rates and service fees, then apply them selectively or automatically to your products and tickets.

Understanding Taxes and Fees

Before setting up your event's financial structure, it's important to understand the difference:

- Taxes: Government-required charges (like sales tax, VAT, or GST) that you're legally obligated to collect

- Fees: Additional charges you add to cover services, processing costs, or other expenses

You have complete control over how taxes and fees appear to your customers - either included in the displayed price or added at checkout.

Setting Up Taxes and Fees

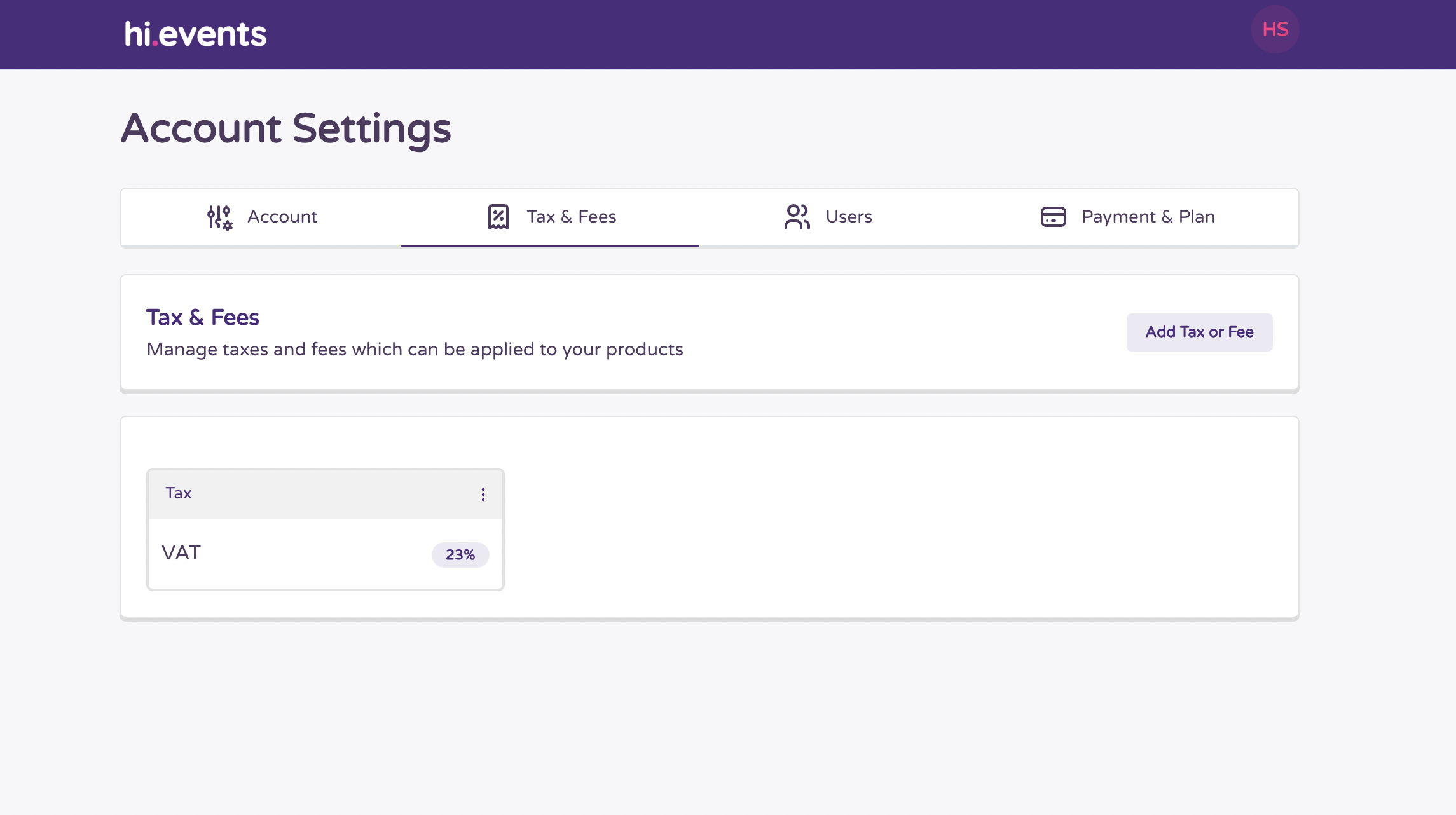

1. Access Tax and Fee Management

Navigate to the taxes and fees section in your account settings.

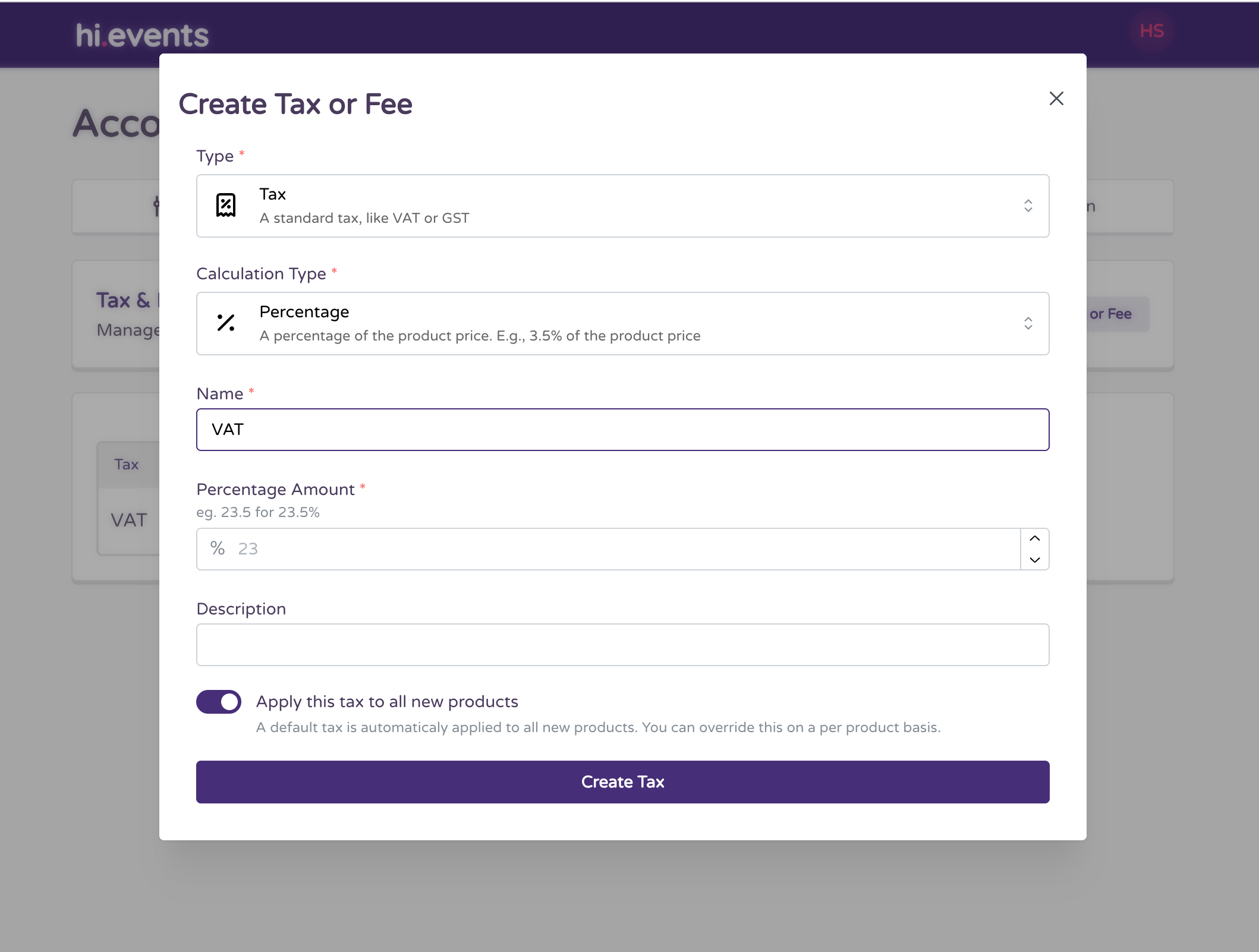

2. Create a New Tax

Add taxes relevant to your jurisdiction and event type.

Key Tax Settings:

- Name: What customers will see (e.g., "Sales Tax", "VAT")

- Rate: Percentage or fixed amount

- Auto-apply to new products: Automatically add this tax to all new tickets/products

- Include in displayed price: Show prices tax-inclusive or add tax at checkout

3. Create Service Fees

Set up additional fees to cover processing costs or service charges.

Key Fee Settings:

- Name: What customers will see (e.g., "Processing Fee", "Service Charge")

- Rate: Percentage or fixed amount

- Auto-apply to new products: Automatically add this fee to all new tickets/products

- Include in displayed price: Show prices fee-inclusive or add fee at checkout

Applying Taxes and Fees to Products

Option 1: Automatic Application

When creating taxes or fees, enable "Auto-apply to new products" to add them automatically to any new tickets or products you create.

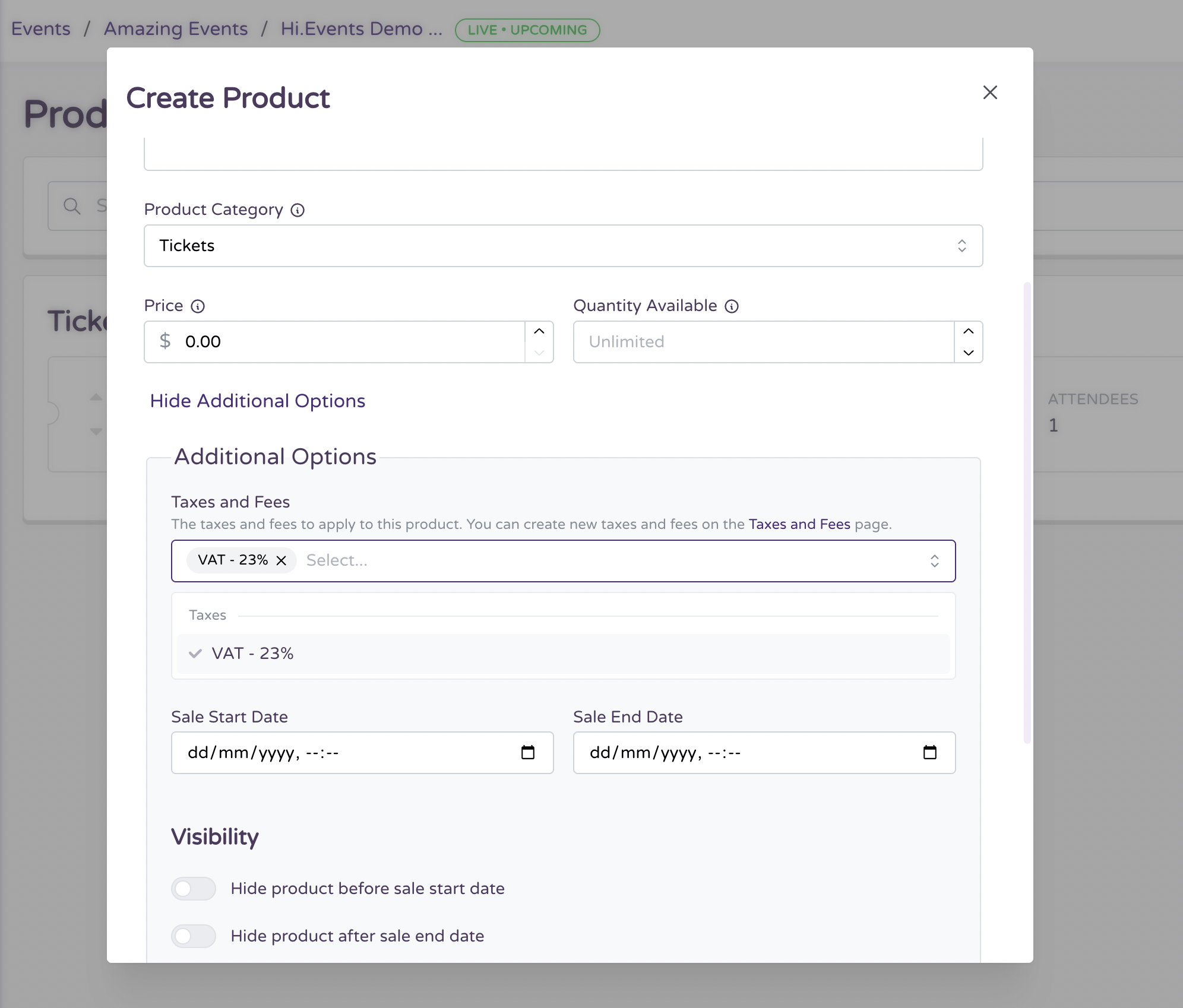

Option 2: Selective Application

Apply specific taxes or fees to individual products:

- Edit the product or ticket

- Under "Additional Options"

- Select the relevant taxes and fees

- Save your changes

Managing Price Display

Hi.Events offers two ways to display prices:

Inclusive Pricing

Customers see the final price upfront. The ticket appears as:

"VIP Ticket - $110"

(Where $100 is the base price and $10 is tax)

Benefit: Transparent final price, no surprises at checkout

Toggle these settings individually for each tax and fee in your account settings.

Frequently Asked Questions

Can I pass the Hi.Events platform fee onto my customers?

Yes, this is entirely up to you. Many organizers create a service fee that matches the Hi.Events platform fee, effectively passing this cost to the customer. Simply create a fee with the same percentage as your platform fee and apply it to your products.

Are tax calculations automatic?

Hi.Events calculates the tax amounts automatically based on the rates you set, but you are responsible for setting the correct tax rates according to your jurisdiction.

Can different products have different tax rates?

Absolutely. You can apply different taxes and fees to different products, allowing for complete flexibility in your pricing structure.

How do refunds work with taxes and fees?

When processing refunds, taxes and fees can be included in the refund amount according to your refund policy. The system will calculate the appropriate amounts based on your settings.

Can I change tax rates for existing tickets?

Yes, you can update tax rates at any time. For tickets already sold, the original tax rate will apply. New purchases will use the updated rate.

Best Practices

- Research local regulations: Ensure your tax setup complies with local tax laws

- Be transparent: Clearly communicate all fees to your customers

- Consider absorption: For premium events, consider including fees in your base price

- Review regularly: Tax regulations change, so review your settings periodically

- Test the checkout process: Experience the purchase flow as your customers would

Remember that while Hi.Events provides the tools to manage taxes and fees, you are responsible for ensuring compliance with tax laws in your jurisdiction.